Creating a small business comes with numerous responsibilities, and ensuring compliance with the Americans with Disabilities Act (ADA) is crucial. ADA inspections help identify necessary adjustments for accessibility, which ultimately benefits all aspects of employment, including overtime regulations. Understanding and implementing these requirements can also lead to significant tax savings through eligible credits and deductions. From essential accessibility features in physical locations to improving your website’s digital accessibility, this guide covers the vital components of ADA compliance. Keep reading to explore each section, including how to effectively train your staff and navigate compliance for service and emotional support animals.

When I think about ADA compliance for small businesses, I realize how important it is to understand what being compliant truly means. Identifying my business as ADA compliant starts with understanding the essentials of ADA Title III. This section focuses on ensuring that my goods and services are accessible to all customers, including those who use screen readers or require other assistive technologies. Additionally, I need to familiarize myself with the key regulations that specifically affect small businesses, including any that might relate to employment and minimum wage through programs like CASP ada inspections. This understanding not only protects my business but also enriches the experience for my customers by promoting inclusivity.

To identify my business as ADA compliant, I first assess my physical and digital environments to ensure they meet accessibility standards. This means reviewing everything from my website to my office layout, making necessary adjustments, and documenting each change for my records. I also need to stay informed about how compliance interlinks with payroll practices and any relevant stipulations from the Internal Revenue Service, reinforcing my commitment to an inclusive and safe space for all my customers.

ADA Title III holds significant implications for small businesses like mine, particularly within the retail sector. It emphasizes the necessity for web accessibility, ensuring that my online presence is navigable for all users, including those who rely on assistive technologies such as braille displays. Understanding my jurisdiction’s specific requirements helps me avoid potential penalties and fosters a welcoming environment for customers of all abilities, while simultaneously enhancing my business reputation and customer loyalty.

As a small business owner, I must be aware of specific ADA regulations that directly impact my operations. One crucial regulation pertains to accessible seating and pathways for individuals using motorized scooters, ensuring everyone can navigate my establishment comfortably. It’s also essential for me to keep an updated FAQ section on my website that addresses accessibility policies, which reflects my commitment to best practices and adherence to wage requirements for employees with disabilities.

Creating an accessible environment starts with essential features that promote equal opportunity for all customers. I’ve learned that having accessible entrances and exits is crucial, as it sets the tone for inclusivity from the moment someone arrives. Additionally, understanding how to navigate accessible parking requirements can ease the experience for those with disabilities and provide reasonable accommodations. The bathroom facilities are another critical area; they must meet specific accessibility standards to serve all patrons effectively. Inside my business, ensuring clear paths of travel that accommodate mobility devices is vital for compliance and overall customer satisfaction. As I take the necessary steps towards construction and renovations, I also keep in mind the potential tax deduction benefits available to support these efforts in achieving ADA compliance.

Ensuring that my entrances and exits are accessible is not only a legal requirement but also a vital step in minimizing risk for individuals with disabilities. I must adhere to the local building code, making sure that ramps and doors allow for easy navigation without compromising on safety standards set by occupational safety and health regulations. While there may be an initial expense associated with these modifications, the long-term benefits in terms of customer goodwill and compliance outweigh these costs significantly.

Navigating accessible parking is essential for creating a welcoming environment for all customers, including those who use assistive technology. I ensure that designated parking spaces are clearly marked and located near the entrance, allowing easy access for individuals with mobility challenges or visual impairment. Furthermore, I install appropriate signage that may include information in sign language to aid those who require additional assistance while moving through the aisles of my establishment.

Ensuring bathroom accessibility standards is fundamental to maintaining compliance with the law and avoiding discrimination against individuals with disabilities. I consider incorporating features such as grab bars, lower sinks, and accessible stalls, as this not only enhances the experience for my patrons but can also positively impact my revenue by attracting a diverse clientele. Regular inspections of these facilities ensure they meet the required job description for ADA compliance, allowing me to continually promote inclusivity in my business environment.

To ensure accessible paths of travel inside my business, I collaborate with an architect to design layouts that facilitate easy navigation for everyone. It’s crucial to remove obstacles and create wide enough walkways that accommodate mobility devices, ensuring that both customers and employees, regardless of their needs, can move freely. By integrating these considerations into my employee benefits package, such as providing adequate sick leave policies, I foster a supportive atmosphere that champions inclusivity and accessibility.

In addressing the importance of digital accessibility on my small business website, I focus on the Web Content Accessibility Guidelines (WCAG) to ensure my online platform meets necessary standards. I recognize that implementing these guidelines not only benefits individuals with disabilities but also enhances user experience for everyone. To assess my website’s accessibility, I leverage various tools that help identify areas needing improvement. Considering factors related to human resources and ensuring compliance with regulations from the Occupational Safety and Health Administration can be overwhelming, but prioritizing website usability allows me to create an inclusive space for all users. In addition, I evaluate my property’s digital presence to ensure it aligns with my commitment to accessibility, promoting equal access to information seamlessly across my online services.

The Web Content Accessibility Guidelines (WCAG) serve as a critical resource for my small business as I strive to create an accessible digital presence. By following this checklist, I can ensure that my website accommodates all users, including those who may be accompanied by a service animal or rely on assistive technologies. Adhering to these guidelines not only meets compliance requirements but can also enhance my organization’s credibility and open up avenues for potential tax credits associated with adopting inclusive practices.

Utilizing tools for testing website accessibility has become a key focus for me as I strive to ensure my digital presence meets ADA standards. I regularly turn to resources such as automated accessibility checkers that highlight issues like missing alt text or color contrast problems. Additionally, I conduct manual testing with screen readers to further understand the user experience for individuals with disabilities, allowing me to make informed improvements to my website.

To ensure my website is usable for people with disabilities, I focus on designing features that facilitate ease of navigation. This involves using clear and descriptive headings, logical structure, and alt text for images to provide context. By prioritizing simplicity and clarity in my site layout, I create a more inclusive environment for all visitors, enhancing their overall experience.

In my journey to ensure ADA compliance, I’ve realized understanding the distinction between service animals and emotional support animals is crucial. Service animals, specifically trained to assist individuals with disabilities, have distinct rights under the ADA. I need to ensure I am well aware of these rights to foster an inclusive environment for customers who rely on them. Additionally, creating a welcoming space for service animals not only safeguards my legal responsibilities but also enhances the overall experience for patrons. By addressing these topics, I can better serve my customers while reinforcing my commitment to accessibility and inclusion.

As I navigate the intricacies of ADA compliance, I find it essential to understand the clear distinctions between service animals and emotional support animals. Service animals are specifically trained to perform tasks for individuals with disabilities, such as guiding those with visual impairments or pulling a wheelchair. In contrast, emotional support animals provide comfort through their presence but lack the specialized training required to qualify under ADA definitions, which impacts how I accommodate them in my business.

As a small business owner, I must ensure that customers with service animals enjoy full access to my establishment. Under the ADA, individuals accompanied by service animals cannot be discriminated against based on their need for assistance, and I am responsible for recognizing these animals as necessary aids for navigation and support. Understanding these rights fosters a respectful environment where all customers can feel welcome and valued, enhancing their overall experience at my business.

Creating a welcoming environment for service animals begins with my understanding and acceptance of their crucial role for many customers. I make sure to communicate openly with my staff about the importance of welcoming these animals, training them to recognize and respect the presence of service animals in my establishment. By fostering an atmosphere of respect and understanding, I not only comply with ADA regulations but also ensure that all my customers feel valued and comfortable as they navigate my business.

In my efforts to ensure comprehensive ADA compliance, I recognize how vital it is to develop a solid training program for my staff. Effective training empowers employees with the knowledge they need to create an inclusive environment, ultimately enhancing customer interactions. I focus on key topics such as understanding ADA requirements, recognizing different types of disabilities, and implementing practical strategies to assist all patrons. Additionally, I prepare my team for handling customer inquiries about our ADA policies, ensuring they can confidently communicate our commitment to accessibility. By investing time in staff training, I not only foster a culture of inclusivity but also safeguard my business against potential compliance issues.

To develop an effective ADA training program for my staff, I start by identifying key areas that require focus, such as the legal aspects of ADA compliance and practical techniques for assisting customers with disabilities. Engaging my team in interactive training sessions encourages open discussions about their experiences and challenges, fostering a deeper understanding of inclusivity. By regularly updating the training materials and incorporating feedback, I ensure my staff is well-equipped to create a welcoming environment for all customers.

In my ADA compliance training program, I prioritize covering the specifics of different disabilities and their implications for customer service. Educating my staff about how various disabilities impact individuals’ interactions with my business equips them to offer appropriate assistance. Additionally, I include practical scenarios to demonstrate appropriate responses, ensuring my team is prepared to handle real-life situations effectively.

I also emphasize the importance of communicating my business’s ADA policies clearly and effectively to all customers. This involves training my team to engage in respectful dialogues about accessibility options and accommodations, fostering an environment where customers feel comfortable discussing their needs. By addressing these communication skills, I empower my staff to enhance the overall experience for all patrons.

Lastly, I highlight the significance of ongoing education and awareness in maintaining compliance. Encouraging my team to stay informed about changes in ADA regulations and best practices ensures that we continually uphold a welcoming atmosphere and actively promote inclusivity within our business. This commitment to continuous improvement builds trust with my customers and enhances our reputation.

When customers approach me with questions about my ADA policies, I ensure I respond with clarity and professionalism. I make it a priority to actively listen to their concerns, showing that I value their inquiries and am committed to addressing their needs. By providing transparent information and demonstrating my dedication to accessibility, I foster trust and encourage an inclusive atmosphere that benefits everyone.

Understanding the financial benefits tied to ADA compliance is essential for any small business owner like myself. I’ve found that there are specific ADA tax credits available, which can significantly ease the burden of implementing necessary accessibility measures. Additionally, various expenses related to ensuring my business meets ADA standards can qualify for deductions, promoting a more inclusive environment without jeopardizing my finances. Navigating the process of claiming these credits and deductions may seem perplexing, but I am committed to learning the steps needed to take full advantage of these opportunities, ultimately supporting my business while fostering inclusivity.

To qualify for ADA tax credits, I must ensure my business implements certain accessibility features that meet the required standards. I’ve learned that expenses such as modifying facilities, purchasing adaptive equipment, and purchasing services from individuals with disabilities can often be eligible. By staying informed about the specific criteria and necessary documentation, I can maximize my benefits while fostering an inclusive environment.

As I navigate the financial aspects of ADA compliance, I’ve recognized several types of expenses that can be covered by tax deductions. Costs related to upgrading facilities, such as installing ramps and accessible restrooms, generally qualify. Additionally, expenses for purchasing adaptive equipment or providing specialized training for staff also fall under these deductions, which ultimately support my efforts to create a more inclusive environment.

Claiming ADA tax credits and deductions requires me to stay organized and informed about the specific eligibility criteria set by the IRS. I gather all necessary documentation, such as receipts for expenditures related to accessibility modifications and improvements. When it comes time to file my taxes, I fill out the appropriate forms, and I make sure to consult with a tax professional if needed to ensure I’m maximizing the benefits available for my small business.

A comprehensive ADA compliance guide is essential for small businesses to create an inclusive environment for all customers. By understanding and implementing key regulations, I can ensure equal access to my goods and services while enhancing customer satisfaction and loyalty. Investing in staff training and maintaining accessible physical and digital spaces protects my business from potential legal issues. Ultimately, embracing ADA compliance improves my business reputation and fosters a welcoming atmosphere for everyone.

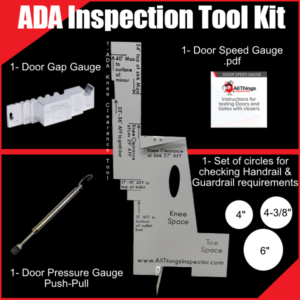

Measuring door pressure is acting in compliance with building regulations, like the Americans with Disabilities Act (ADA). It’s an important step in ensuring accessibility, safety

When talking about building safety, the first things that come to mind are fire alarms, emergency exits and security systems. Meanwhile, the one tool that